While reports are that Patrick Swayze is responding well to his cancer treatments, it seems he is still preparing for the worst case scenario. He’s put all of his assets into a living trust, so that if he does die they will be disposed of in the way he wants.

Fans of ailing movie hunk PATRICK SWAYZE have been left fearing for the worst after learning the GHOST star has put all of his real estate into a living trust.

The actor, who is fighting deadly pancreatic cancer, has filed papers suggesting he’s getting his affairs in order.

The documents are traditionally filled out by people on the verge of death, who want to make sure all of their final wishes are taken care off after they die.

The paperwork, obtained by U.S. TV news show Entertainment Tonight, was filed on 28 March (08).

This isn’t your cue to worry that his condition is much worse than what reports indicate. While these papers are usually only filed when someone is close to death, it makes sense to me that anyone with a potentially terminal illness should make sure their affairs are in order.

Patrick has been getting a little bit of special treatment from NASA.

Patrick Swayze has been granted special permission to use a NASA airstrip in California, so he can fly himself to hospital for cancer treatment.

Moffett Federal Airfield near San Francisco is designated for government use only and is totally closed to civilians – but the actor and flying fanatic has reportedly been using the runway to jet between his home in southern California and Stanford University Medical Center.

A source tells Florida’s Palm Beach Post newspaper Swayze is using the ex-navy base to avoid the paparazzi when he makes bi-monthly trips for chemotherapy.

I don’t know if this is true, the report only comes from a ‘source’, but if it is then it indicates that Patrick is in good enough health to fly himself to hospital.

His wife Lisa Neimi has thanked people for their support, saying “We can’t help but feel that all the prayers, meditations and good thoughts sent his way by everyone has made a difference.” Hopefully Patrick keeps sending us positive reports, and his living trust never gets used.

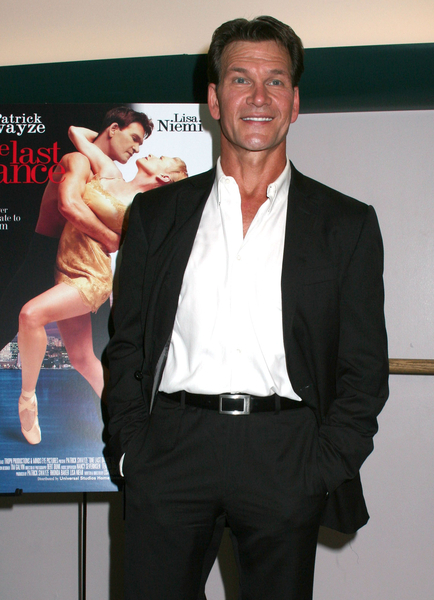

Patrick Swayze is shown at a One Last Dance Movie and Benefit Performance on 08/23/05, thanks to PRPhotos.

everyone should arrange things in case of ones death. it´s a scary thing to do if you´re not about to die or if you´re not terminally ill. but death is inevitable and one should take care of things earlier in life, there are people to consider who need to be cared for and somtimes people pass suddenly without leaving any will.

Totally agree. Dying intestate just adds to the pain and stress and should be avoided if at all possible. People need to get over their squeamishness about this.

Having said that, hope he’s doing well.

Love Patrick Swayze. Beautiful, graceful and classy soul. He’ll always be one of my all round favorite actors and one of the rare ones whose reputation as a great guy with a good family life is apparently as real as it seems. Good karma from a good place. Hope he gets better and better.

Why does he get special Treatment from NASA ?

It is smart that he is doing that. The horribly tragic thing about cancer is that one can seem to be doing terrific, and then the next day be dead (happened to my friend’s dad). Sending good thoughts his way.

“The documents are traditionally filled out by people on the verge of death, who want to make sure all of their final wishes are taken care off after they die.”

Rubbish! While a FEW people wait until the last minute, these things are usually created by anybody worth a lot of money who is smart and organized. This is what I do for a living. Anybody worth a million give or take, and especially with children and a sizeable estate, should have family trusts set up, if for no other reason than to not get gouged by taxes and/or to control your kids’ spending.

Dying intestate means dying with no will, which is just plain stupid. Especially in California law, and especially if you have kids and a money career like he does.

Shouldn’t that be someone’s private business that they put their assets into a living trust? What business is it to any of the public what he does with his money….I don’t know why anyone other than he and his family should know his personal affairs. Tacky.

GG, you’re correct. Anyone with money should have a living trust anyway, for the tax ramifications, if nothing else. And it’s amazing how many people actually have a net worth of close to a million, when you add up $300,000 houses and $200,000 in the 401K and cars, furnishings and what not.

I don’t think Patrick Swayze has kids, though, does he? But in any event it’s a good thing to look out for his wife. Nice guy, and it’s sad he’s got this thing.

Milton, ultimately, NASA’s property is the taxpayers’ property as they are funded by the Federal Government.

Living Trusts are something that most wealthy people use to keep their inheritors from having to pay estate taxes and to ‘dispose’ of assets. VERY common practice among the wealthy and a very common ‘estate planning’ tool. I used to be in the legal field and we prepared these all the time.

Living Trusts are used by the wealthy to ‘dispose’ of their assets so they can qualify for government-sponsored plans like Medicare. You can’t have more than about $2,000 in tangible assets to qualify for Medicare (that was the level a few years ago, it might have changed since then).

Yep, it’s disgusting – the extremely wealthy ‘give’ all of their assets to Living Trusts and thus get to have the Feds pay for the medical care. Sadly, Medicare is supposed to be there for people with NO money, not the scheming rich. 👿

I’m truly not suggesting that’s Swayze’s motivation for preparing a Living Trust, it’s just a disgusting practice by lots and lots of wealthy people. Suggesting they are prepared solely for tax purposes is ingenuine.

I really don’t think he’s responding to chemo as well as they say he is. Unless you catch pancreatic cancer very early (which is rare due to lack of symptoms at the beginning), the prognosis isn’t good. My grandmother went to the doctor complaining of stomach aches, was diagnosed with pancreatic cancer, and died less than four months later (without chemo).

I hope his family remains strong throughout this. It must be incredibly scary to be in his shoes right now.

DC Native, I think you may be confusing Medicare and Medicaid. Medicaid is the one for the indigent, everyone 65 and older gets Medicare, at least Part A, which is free and covers hospitalization. Part B, which covers doctors, costs our elderly almost $94 a month (criminal when some of them are trying to live on $800 or $900 total), and Part D, for prescriptions, you arrange through a third party (and pay for). My Medicare card arrived in the mail about a month before I turned 65. I didn’t apply, didn’t need it (I’m still employed full time and my employer provides medical insurance). It’s automatic and is based on your age, not your wealth.

DC Native, I have a living trust and it has nothing to do with medical care or trying to get out of paying it. We did it to make sure our assets end up where they should, plain and simple. Medical coverage was never even discussed in any of the many many meetings with our attorney that it took to pull this thing together, just our wishes for end of life care.

So ingenuine, no, just basic financial planning.

I have a living trust. I have had one since I was 14. It keeps your will out of probate and the tax liability is much smaller than that of an estate in probate. It is a very wise move.

I hope he will recover.

Syko, you’re right – I confuse the 2 especially since it’s been years since I did that kind of work.

LTSFe, you work with a very uncommon attorney. Good for them (no sarcasm intended).

While I agree that some people do use the Trusts solely for tax purposes, the majority of the people we prepared them for DID use them in order to reduce personal assets in order to take advantage of federal benefits. Those people always claimed it was to protect their assets from long-term illness expenses. Most health insurance policies have a $1M LIFETIME maximum and indeed are not enough to cover a lot of common illnesses. 😥 My personal experience is that more people chose to use the Trusts to get Federal benes than for simple tax purposes. Again, I don’t suggest that’s Swayze’s intent or the intent of EVERYONE who uses Trusts, but during estate planning, a lot of people use them for BOTH taxes AND health benes. I was just pointing out that trusts are used for that purpose as well. It made me pretty sick to see the wealthy in our small town *scramble* for these Trusts so they’d qualify for Federal benefits – and I knew their intent since I dealt with them face-to-face preparing the documents. Right before I quit, the Family Limited Partnerships started up and now there are a variety of trust-type vehicles available that allow people to dispose of assets. I simply don’t think it’s reasonable that a wealthy person can ‘save’ their assets for the inheritors who did NOT work for them and then use taxpayer funds to pay for their health care. Estate taxes are horrific and SHOULD be reformed, along with health insurance. If you pay a premium to have your medical costs covered, then by God, they should pay all of the costs, not just STOP when it gets too pricey. I’m not a socialist but health insurance companies earning profit is just despicable.

As a Former Trust Admin, trusts are definitely NOT for the wealthy only. And they are QUITE taxable. However, with the Republican “Death Tax BS” .. rest assured, they are no longer taxed at high enough rate, in my very experienced opinion. [I mean .. Hello?? Shouldn’t those with several million be taxed at a higher rate than you and me? Courtesy of the government *rude awaking coming!!* they aren’t.] I strongly advise anyone with any assets look into a will – for sure – and if you have greater than $100k in assets, a trust can be beneficial. Besides, someone else will manage them and you can sue them if they screw up . unlike a regular broker situation. [And please .. Rest assured .. I have no such bounty .. lest some think I am of the greedy wealthy bastard class.. neither were 95% of my clients.]

As for the assertion that a 14 year old opened a trust, uh .. no. The youngest age at which a trust can be created by a person – as allowed by IRC – that’s the Internal Revenue Code – is 18 years of age. What you probably had was an “infant trust” – meaning you were not free to withdraw any funds from an account unless your Trustee [a parent or guardian] signed off on it. Your Trustee was in total control of the account. [There is a reason child stars sue their parents, people! 😉 ]

Also, I know this because I had a kidney transplant – hence the “former” Trust Admin part, Medicaid is not just for indigents. Medicaid helped pay for my transplant and the 5 years of dialysis I had prior to it – along with my Blue Cross Blue Shield. Medicaid also helped pay for my anti-rejection meds for a time. {Quick FYI .. If you have any other transplant other than kidney, Medicaid helps pay for life or the life of the recipients organ. Lucky me .. I now pay $1500+ a month for my anti-rejections meds after the end of Medicaid’s assistance. Hence .. the not being a wealthy greedy bastard .. not that I was one before either.

Anyway, with regards to Mr. Swayze, I just saw “To Wong Foo” last night on Starz. I have never been a great Patrick Swayze fan – lack of seeing his films more than anything – but he was really great in that movie. It’s very sad to know what a horrible painful disease he has. My Mom’s best friend’s husband and my former dentist passed on St. Patrick’s Day after battling this insidious disease for a little under a year. I only hope that if he is going to pass from this, he goes quickly and with a little pain as possible.

After researching Pancreatic Cancer for my Mom after her friend’s husband’s diagnosis, I made the decision that if I ever am diagnosed with this disease I would take the quickest exit out. In other words, Hemlock Society .. here I come! Though – I surely hope not to ever receive this diagnosis.

Many heart felt best wishes to Mr. Swayze .. I will hope for a miracle for him.

Sorry for the TMI post .. I appear to be in over-share, know-it-all mode tonight! 😐

Sorry DC Native, just saw your post above. I am not sure where you practice, but in Illinois, Minnesota and Florida, Living Trusts have no legal implication for gaining access to Federal benefits – aka Medicare or Medicaid… even social security for that matter. [And yes, the wealthy do collect SSI benefits.]

Perhaps you might have been confused dealing with a client who wished to place assets and real estate into trust in order to protect them? I have had clients move assets into trust when catastrophic illness made it likely their assets could be seized then liquidated to pay what we call “gaps” in medical debts not covered by private insurance or Medicare/Medicaid … think Alzheimer’s. That is an exceedingly devastating disease for everyone effected, wealthy and poor alike.

Also, as is often the case when a husband becomes ill before a wife [though it is obviously not always the case that the man has the money or even gets sick first], they will often place assets in trust to preserve them for their spouse to live on after they are gone. To be sure, trusts are also created for the children and grandchildren and in the case of very large trusts of the mega-rich, several generations to follow. However, most average trusts are under $10 million dollars, are created to allow the spouse a comfortable existence after their loved one has passed and usually have some assets that are preserved for the children ..and nowadays grandchildren.

I will not begin to go into the obvious issues you have with the beneficiaries of these trusts. But suffice to say, most of my clients didn’t consider their spouse, children or grandchildren deadbeats ill deserving of being taken care of after their passing. [Not every “trust fund baby” has the morals and lack of grey matter exhibited by Ms. Paris Hilton.] Most clients wanted their loved ones provided for – some with a frightening eye towards the economic future we are seeing now – where life is a struggle just to fed yourself – much less send a child to college or what have you. They had their loved ones best interests at heart.

So, please try not to be hatin’ on trust beneficiaries or those who open them. As I said, the vast majority are not opened by greedy scumbags looking to screw the system royally .. there are those ***holes out there, to be sure. But most are set up for an honorable and legitimate reasons – to take care of loved ones in a time of great change and need.

Living trusts (also called revocable trusts) have little to do with taxes or “hiding assets.” Rather they provide for the orderly administration of assets in the event of the inability of the grantor to manage his affairs and they provide for the post death orderly distribution of assets. In addition they avoid estate probate and the statutory attorney fees related thereto. These fees can be sizable. In certain circumstances they can also replace the need for a will.

Hey I just wanted to let you know, I actually like the composition on your web site. But I am employing Firefox on a machine running version 8.x of Xubuntu and the UI aren’t quite kosh er. Not a big deal, I can still essentially read the articles and look for for information, but just wanted to inform you about that. The navigation bar is kind of difficult to apply with the config I’m running. Keep up the great work!

You can join now and watch movies online on your Mac, hp, Compaq, Toshiba, dell pc if you are connected to the internet. Most movie download sites are however fake and will not give you any good movies to watch online. You will need to know how to tell the best from the worst.